One of the Democrats see-saw battles internally has been over free trade/fair trade. On the one hand, middle-to-middle-left Democrats see free trade as a good thing, an almost Republican position if you believe the smears.

On the other hand, more left-of-center Democrats believe free trade is a mask to cover predatory capitalism's exploitation of poorer nations and people, including poorer Americans, and that fair trade or barriers to trade are needed.

Both, sadly, are correct positions, which is what makes trade an issue that is not easily resolved at the grass-roots level, and has given the Republicans an economic and foreign policy plank in their platform, not to mention reinforced their arguments regarding tax cuts.

Until now.:

WASHINGTON -- By a nearly two-to-one margin, Republican voters believe free trade is bad for the U.S. economy, a shift in opinion that mirrors Democratic views and suggests trade deals could face high hurdles under a new president.Note the slightly subtle undercurrent in general Republican opinion, apart from the trade issue: tax hikes on the wealthiest, and protections for poor working Americans.

The sign of broadening resistance to globalization came in a new Wall Street Journal-NBC News Poll that showed a fraying of Republican Party orthodoxy on the economy. While 60% of respondents said they want the next president and Congress to continue cutting taxes, 32% said it's time for some tax increases on the wealthiest Americans to reduce the budget deficit and pay for health care.

Six in 10 Republicans in the poll agreed with a statement that free trade has been bad for the U.S. and said they would agree with a Republican candidate who favored tougher regulations to limit foreign imports. That represents a challenge for Republican candidates who generally echo Mr. Bush's calls for continued trade expansion, and reflects a substantial shift in sentiment from eight years ago.

All this comes on the heels of seven years of "unfettered economic improvement" (I'll get back to that in a moment), a rising if faltering stock market, and a President who goes out of his way to remind people of how his tax cuts put a lot of money in their pockets.

Um. Yea. Not so much...

If you take a look around the current economic landscape, you see the ghosts of our past fiscal party draped over the furniture: easy credit, rocketing house values, low interest rates, predatory lending.

None of which has anything to do with tax cuts. Where tax cuts could have and should have helped middle class Americans, putting more money in their pockets through reduced tax bites and, more important, higher wages, never happened. Wage growth was actually down for the first term of Bush's administration and it wasn't until 2006 that the average caught up and surpassed the average wage in 2000, adjusted for inflation.

In point of fact, the last seven years' spending is probably the result of one unintended impact of Bush's tax cut and one other factor that had nothing to do with taxes whatsoever.

When Bush cut taxes, three times, the logic should have flowed like this: tax cut equals increased spending by businesses and the public equals higher interest rates as credit tightens (companies leveraging their new-found money into capital purchases, people buying bigger homes).

What happened instead was something a little different: tax cut equals increased dividends and capital gains recognition equals lower economic activity equals a further lowering of interest rates to avoid recession.

That extra money, in other words, flowed to wealthier people who didn't need to spend it, instead investing it where they could get a great return. That would normally be a good thing for America, but here's the unintended consequence and why this happened: the rest of the world's economy was starting to ramp up and catch up to the American economy.

Those extra dollars weren't invested here, but in Europe and Asia, particularly China and India, which explains how, while our economy is basically stagnant at the consumer level, our corporations are still making money hand over fist on their overseas activity and the stock markets, never a good economic indicator except in retrospect, are breaking records.

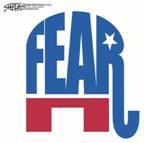

The other factor? The psychology of September 11 and the fear that the administration has made certain to simmer since.

You get panicked and you need to be comforted. In America, that leaves one thing to do: shop. Bush's speech on this point was unnecessary. People weren't in economic hardship, so they weren't about to stash money in their mattresses, waiting for the rabid Islamist horde to come ravage their daughters and raid their banks.

Material acquisition, for reasons I'm not qualified to truly explore, seem to comfort us. Perhaps it's the whole "keeping up with the Joneses" mentality we've been inculcated with, or perhaps it's merely the feel that, in some bizarre way, we've "conquered" something and gained wealth.

It's the wealth angle that strikes me about the past seven years. The rising housing prices, the increased equity people gain in their homes with each mortgage payment, the ability to trade up, quickly turning a $250,000 investment into a $500,000 one by selling the $250K house for $300K, then buying the $500K house with the proceeds, minus the vig for yourself, and a bigger mortgage, feeds right into this acquisitive mentality.

And now we're seeing the bitter fruit of the leftover market. Sure, some people made a ton of money, early on, in the boom, but now you're seeing house prices slipping, and interest rates creeping up, which means house prices will slip further. Now, add to that the baby boomers downsizing their houses as the kids move on, and you've got a really chance of a shrinkage in wealth not seen since the Great Depression.

And people have less and less money to spend. And now, the job market is starting to catch up.

This is not going to be pretty, but the good news is the other half of the country is starting to wake up and realize how bad things really will be. It's a Pyrrhic victory we financial wonks on the left are celebrating, to be sure, but it bodes well for recovering from this horrible tragedy to come.